Navigating Cannabis Lending in an Evolving Industry: Canna Business Resources Offers Tailored Financing Solutions for Cannabis Businesses

ACCESS Newswire

22 May 2023, 18:35 GMT+10

NEW YORK, NY / ACCESSWIRE / May 22, 2023 / The cannabis industry is experiencing rapid growth, with increasing legalization of both medicinal and recreational use in various states. As established cannabis businesses strive to expand their operations and enhance their infrastructure, the need for loans has become evident. However, navigating the lending landscape poses challenges, as many financial institutions remain hesitant to work with cannabis businesses due to ongoing legal and regulatory uncertainties.

To address this pressing need, Canna Business Resources is proud to offer specialized cannabis lending solutions designed to empower cannabis businesses to thrive. With our expertise in the industry and our understanding of its unique challenges and opportunities, we provide tailored financing options that meet the specific needs of cannabis businesses.

Cannabis lending plays a critical role in the growth and development of the industry.

By partnering with Canna Business Resources, cannabis businesses gain access to the capital necessary to expand their product lines, open new retail locations, invest in marketing and advertising campaigns, and more. We are committed to supporting the success of cannabis businesses and driving innovation, job creation, and increased revenue within the industry.

The Current State of Cannabis Lending

Despite the legality of cannabis use in many states, traditional banks remain cautious due to federal regulations. Cannabis businesses face significant hurdles when seeking loans from these institutions. However, there is hope. Specialized cannabis lenders like Canna Business Resources are well-versed in the unique needs of the industry and are more inclined to provide financing solutions tailored to the cannabis sector.

Considerations Before Applying for Cannabis Loans

Before applying for a cannabis loan, it's crucial to consider the following five factors:

- Alternative Lending Options: Explore alternative lending options to secure funding from specialized lenders with expertise in the cannabis industry. Canna Business Resources offers favorable terms and customized financing solutions designed specifically for cannabis businesses.

- Legal Considerations: Understand the legal landscape surrounding cannabis lending, taking into account the varying laws at the state and federal levels. Canna Business Resources is well-informed about the regulatory environment and ensures compliance with all relevant regulations.

- Types of Cannabis Loans Available: Familiarize yourself with the different types of cannabis loans, including equipment financing, working capital, and real estate loans. Canna Business Resources offers a range of loan options to cater to the specific needs of your cannabis business.

- Eligibility for Receiving Cannabis Loans: Prepare your cannabis business for loan approval by meeting certain prerequisites and qualifications, such as having a robust business plan and a track record of financial stability. Canna Business Resources assesses your financial history, revenue, profits, and cash flow to determine eligibility for loans.

- The Future of Cannabis Lending: Stay informed about the evolving landscape of cannabis lending, as new developments and changes in lending practices are likely to occur. Canna Business Resources continuously monitors industry trends to ensure that our clients have access to the latest financing opportunities.

Benefits and Risks of Using Cannabis Financing

Utilizing cannabis financing offers several key benefits for businesses, including rapid access to funds and the ability to fuel growth and expansion. Specialized lenders like Canna Business Resources provide businesses with an opportunity to secure necessary funding quickly and efficiently. Supporting cannabis businesses through financing also presents investors with a chance to earn a solid return on investment while contributing to the industry's growth.

However, it is crucial to consider the potential risks associated with cannabis financing. Higher interest rates are typically attached to cannabis loans due to the perceived higher risk of the industry. It is essential to carefully evaluate the risks and benefits and collaborate with reputable lenders like Canna Business Resources, who provide clear terms and fair interest rates.

Contact:

Canna Business Resources

[email protected]

347-694-4429

SOURCE: Canna Business Resources

View source version on accesswire.com:

https://www.accesswire.com/756306/Navigating-Cannabis-Lending-in-an-Evolving-Industry-Canna-Business-Resources-Offers-Tailored-Financing-Solutions-for-Cannabis-Businesses

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Dallas Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Dallas Sun.

More InformationInternational

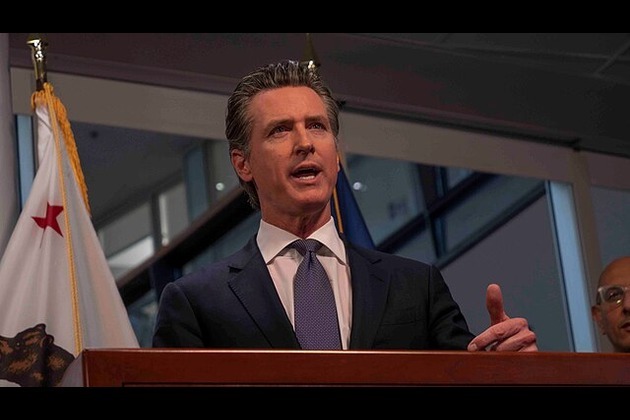

SectionFox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Israel should act fast on new peace deals, Netanyahu says

JERUSALEM, Israel: Israeli Prime Minister Benjamin Netanyahu says that Israel's success in the war with Iran could open the door to...

UN offer rejected in Dreamliner crash investigation

NEW DELHI, India: India has decided not to allow a United Nations (UN) investigator to join the investigation into the recent Air India...

UN climate agency gets 10 percent boost amid global budget cuts

BONN, Germany: Despite widespread belt-tightening across the United Nations, nearly 200 countries agreed this week to increase the...

Business

SectionWall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...